Therefore, we need to transfer the balances in revenue, expenses and dividends (the temporary accounts) into Retained Earnings to update the balance. The company can make the income summary journal entry for the revenue by debiting the revenue account and crediting the income summary account. If the net balance of the income summary is a credit balance, it means the company has made a profit for that year, or if the net balance is a debit balance, it means the company has made a loss for that year. It summarizes income and expenses arising from operating and non-operating activities.

Income summary for revenues

The income summary is an intermediate account to which the balances of the revenue and expenses are transferred at the end of the accounting cycle through the closing entries. This way each temporary account can be reset and start with a zero balance in the next accounting period. At the end of the accounting period, all the revenue accounts will be closed by transferring the credit balance to the income summary.

Income Summary

It works as a checkpoint and mitigates errors in preparing financial statements by directly transferring the balance from revenue and expense accounts. The company can make the income summary journal entry for the expenses by debiting the income summary account and crediting the expense account. As you can see, the income and expense accounts are transferred to the income summary account. This is the second step to take in using the income summary account, after which the account should have a zero balance. The net amount transferred into the income summary account https://www.pinterest.com/kyliebertucci/stampin-up-business-tips/ equals the net profit or net loss that the business incurred during the period.

Advance Your Accounting and Bookkeeping Career

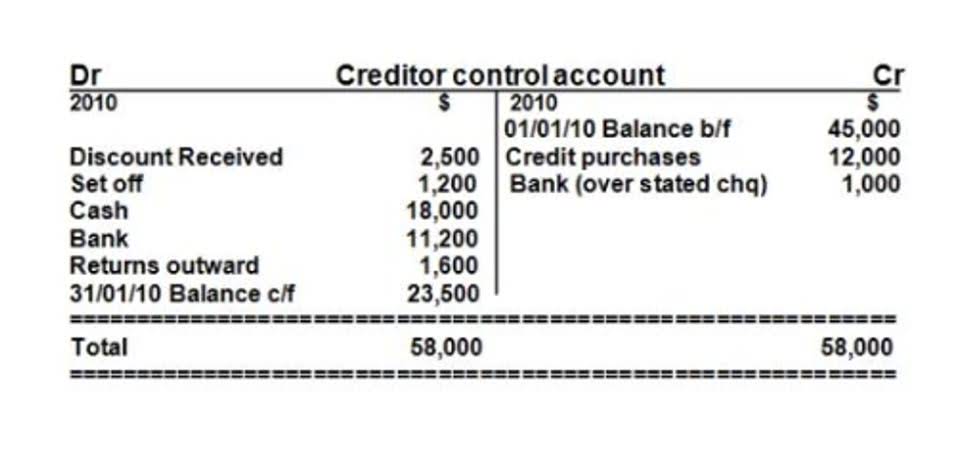

If the credit side is greater than the debit side, the company or the individual is said to have been profitable in the assessment period. In contrast, when there is a loss incurred, the debit side has more value than the credit side of the account. The trial balance, after the closing entries are completed, is now ready for the new year to begin. Think back to all the journal entries you’ve completed so far.

AccountingTools

Notice the balance in Income Summary matches the net income calculated on the Income Statement. We know that all revenue and expense accounts have been closed. If we had not used the Income Summary account, we would not have this figure to check, ensuring that we are on the right path.

- Once the temporary accounts have all been closed and balances have been transferred to the income summary account, the income summary account balance is transferred to the capital account or retained earnings.

- This final income summary balance is then transferred to the retained earnings (for corporations) or capital accounts (for partnerships) at the end of the period after the income statement is prepared.

- XYZ Inc is preparing an income summary for the year ended December 31, 2018, and below are the revenue and expense account balances as of December 31, 2018.

- The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period.

- It was declared at $1.2 billion or %3.03 for each diluted common share.

- Instead of sending a single account balance, it summarizes all the ledger balances in one value.

Financial Accounting I

It is also possible that no income summary account will appear in the chart of accounts. You can either close these accounts directly to the retained earnings account or close them to the income summary account. It is also commonly found that an income summary is confused with an income statement.

Income summary account

- On the other hand, if the company makes a net loss, it can make the income summary journal entry by debiting retained earnings account and crediting the income summary account instead.

- Since it is a temporary ledger account, it does not appear on any financial statement.

- If the credit side is greater than the debit side, the company or the individual is said to have been profitable in the assessment period.

- The amount of money remaining after all expenses are subtracted from total revenues, indicating a company’s profitability.

- This net balance of income summary represents the net income if it is on the credit side.

After these two entries, the revenue and expense accounts have zero balances. The trial balance above only has one revenue account, Landscaping Revenue. If the account has a $90,000 credit balance and we wanted to bring the balance to zero, what do we need to do to that account? In order to cancel out the credit balance, we would need to debit the account. Rather than closing the revenue and expense accounts directly to Retained Earnings and possibly missing something by accident, we use an account called Income Summary to close these accounts. Income Summary allows us to ensure that all revenue and expense accounts have been closed.

After closing all the company’s or firm’s revenue and expense accounts, the income summary account’s balance will equal the company’s net income or loss for the particular period. In such cases, one must close the owner’s income summary account to their capital account. In a corporation’s case, one must close the retained earnings account. The purpose of an income summary account is to close the books.

How to Calculate Income Summary for Closing

This income balance is then reported in the owner’s equity section of the balance sheet. Likewise, shifting expenses out of the income statement requires you to credit all of the expense accounts for the total amount of expenses recorded in the period, and debit the income summary account. This is the first step to take in using the income summary What is partnership accounting account. When you transfer income and expenses to the income summary, you close out the relevant revenue and expense accounts for the period. That lets you start fresh with your accounts for the next period.